52019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Employers goods provided free or at a discount.

Tax Relief For Year Of Assessment 2018 Plctaxconsultants

Particulars of Benefits in Kind 4 7.

. This means that income for the calendar year 2019 is taxable in the YA 2019. Ascertainment of the Value of Benefits in Kind 3 6. Employees Responsibilities 31.

Other Benefits 14 8. All Benefits-in-Kind are technically taxable but Paragraph 8 of the LHDNs Public Ruling No. For example perquisites which cover things like parking medical and.

24 Order 2002 PUA 2102002. 030 Malaysian ringgits MYR per litre is applicable. Goods exempted from Sales Tax include basic food eggs vegetables cereals pharmeceutical products and steel products.

Exemption is available up to RM1000 per annum. You wouldnt want to include any income that is entitled to tax exemptions on your form either. Any benefit exceeding RM1000 will be subjected to tax.

Tax Exemption On Perquisites Received By An Employee 18 8. The Income Tax Exemption No. 2 Order 2019 the Order was gazetted on 27 February 2019 and is effective for the year of assessment YA 2018.

102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. On the first 5000. Employers own services provided full or at a discount Fully exempted 6.

Incorporated under the Companies Act 2016 resident in Malaysia. Objective The objective of this Public Ruling PR is to explain -. SERVICE TAX AMENDMENTS 2019.

The amount of income exempted is based on the value of increased exports as follows. 10 December 2019 Page 1 of 42 1. Interpretation The words used in this PR have the following meaning.

Chargeable Income RM Calculations RM Rate Tax RM 0 5000. Receiving tax exempt dividends. Here are the income tax rates for personal income tax in Malaysia for YA 2019.

1 hour agoMalaysia has extended the timeline for applicants seeking income tax incentives for qualifying activities in the East Coast Economic Region to December 31 2022. This exemption will be applicable to any company in Malaysia who acquires taxable services of Group G item a. Termination of tax exemption for wholesale money market funds for companies.

19 November 2019 attitude she often receives tips from customers who patronise the. Insurance other policies. 24 Order 2002 PUA 2102002.

The existing tax exemption for interest earned on wholesale money market funds will cease with effect from 1 January 2019. Income tax deductions for contributions made to any social enterprise subject to a maximum of 10 of aggregate income of a company or 7 of aggregate income for a person other than a company. Up to RM7000 life insurance.

In addition to the introduction of Service Tax on digital services provided by foreign service providers refer to article in Indirect Tax News Issue 32019 - October 2019 the scope of taxable services subject to Service Tax has been expandedUnder the Service Tax Amendment No. Child-care centres provided by employers. The relief is provided in response to the coronavirus COVID-19 pandemic.

Malaysia only on 26 February 2019 to provide guidance in the application of stamp duty relief. The ECER is one of three economic corridors in with the aim to accelerate economic growth in the country. Food drink provided free of charge.

A specific Sales Tax rate eg. Expansion of scope of service tax and service tax exemptions. On 2 November 2018 Malaysia released its 2019 budget the Budget.

These measures would be effective as from the entry into force of the Finance Act 2019. A The exemption is applicable for service tax registered person in Group G who. The Finance Ministry in late December 2021 extended through 31 December 2026 a tax exemption available for foreign-source income for individuals and foreign-source dividend income for corporate taxpayers subject to certain conditions.

12 December 2019 CONTENTS Page 1. Two-year extension on double. Article Posted date 07 January 2022.

112019 provides for the following exemptions. Goods which are subject to 5 percent Sales Tax include certain food prepared fruits vegetables and meats printers and mobile phones. An individual carrying on a business in Malaysia is assessed tax based on the calendar year to be in line with the assessment year.

Free transportation between pick-up pointshome and work. Types Of Perquisites And The Tax Treatment 7 7. Maternity expenses traditional medicines Fully exempted 7.

Self and dependent relatives. 102019 INLAND REVENUE BOARD OF MALAYSIA Date of Publication. Income Tax Exemption No.

Adequate number of full-time job employment in Malaysia. The incentives include up to 100 percent income tax exemption for a wide range. PUA 1632019 which is effective from YA 2016 to 2020 provides income tax exemption to SMEs on their income from export sales.

For pensionable public servants. Tax Exemption on Benefits in Kind Received by an Employee 14 9. The Budget seeks to invigorate the economy and implement institutional reforms to strengthen fiscal administration manage government debt and raise government revenue.

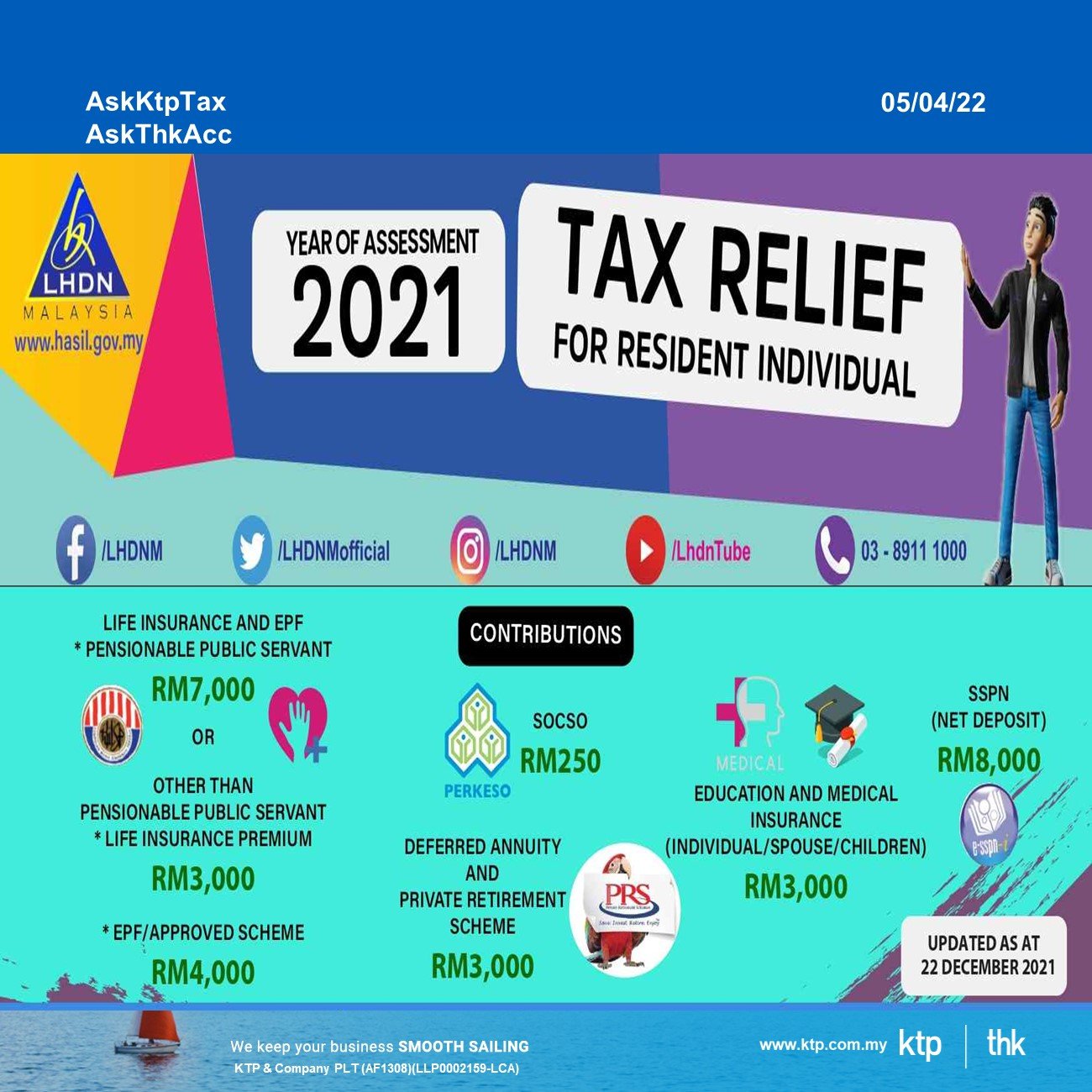

Employers Responsibilities 30 9. Relevant Provisions of the Law 1 3. Life insurance and EPF including not through salary deduction.

Benefits in Kind 2 5. A qualifying company is a company. 2 Regulations 2019 the following.

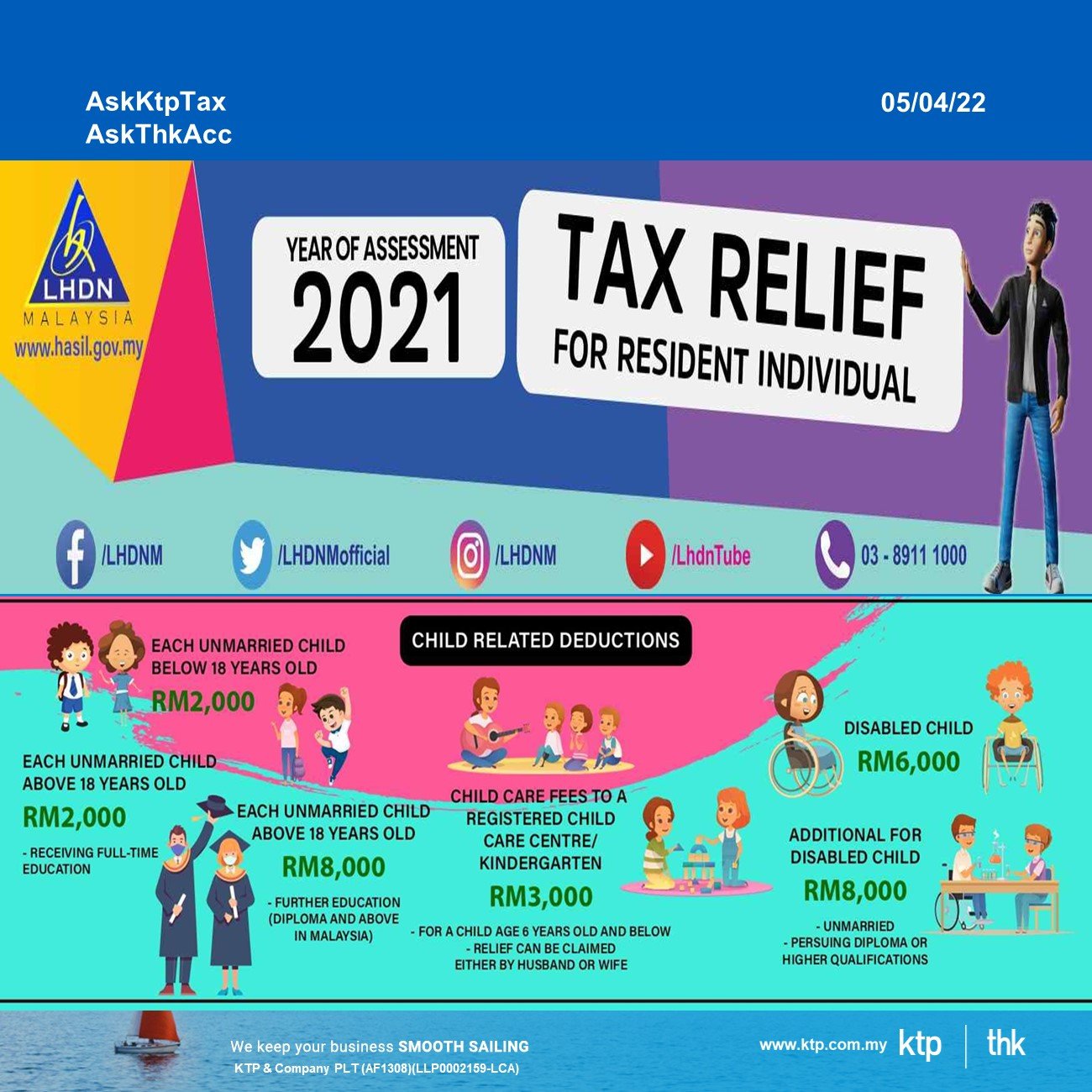

These are the types of personal reliefs you can claim for the Year of Assessment 2021. Short-term visitors to Malaysia enjoy an income tax exemption on employment income in Malaysia if their employment does not exceed. Employers goods provided free or at a discount.

EXEMPTION FROM PAYMENT OF SERVICE TAX UNDER THE SERVICE TAX PERSONS EXEMPTED FROM PAYMENT OF TAX ORDER 2018. Corporate tax highlights.

How To Maximise Your Malaysian Tax Relief And Tax Rebates For Ya2020 Mypf My

Procedures For Travellers Entering Malaysia From 1 April 2022 Updated On 1 July 2022 Home Portal

Jiaaqieats By Jia Qi April 2020

What Is Form Ea Part 1 Defining The Benefits In Kind The Vox Of Talenox

Latest News Chartered Accountant Latest News Accounting

Individual Income Tax In Malaysia For Expatriates

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Goods And Person Exempted From Sales Tax Sst Malaysia

Compensation For Loss Of Employment In Malaysia Tax Treatment Tham Consulting Group

Malaysia Budget 2019 Highlights Mypf My

International Shipping From Singapore To Malaysia Cost How It Works

Malaysia Market Profile Hktdc Research

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Malaysia Budget 2019 Highlights Mypf My

Ktp Company Plt Audit Tax Accountancy In Johor Bahru

Here S 5 Common Tax Filing Mistakes Made By Asklegal My

Income Tax Malaysia 2018 Mypf My

Lhdn Irb Personal Income Tax Relief 2020

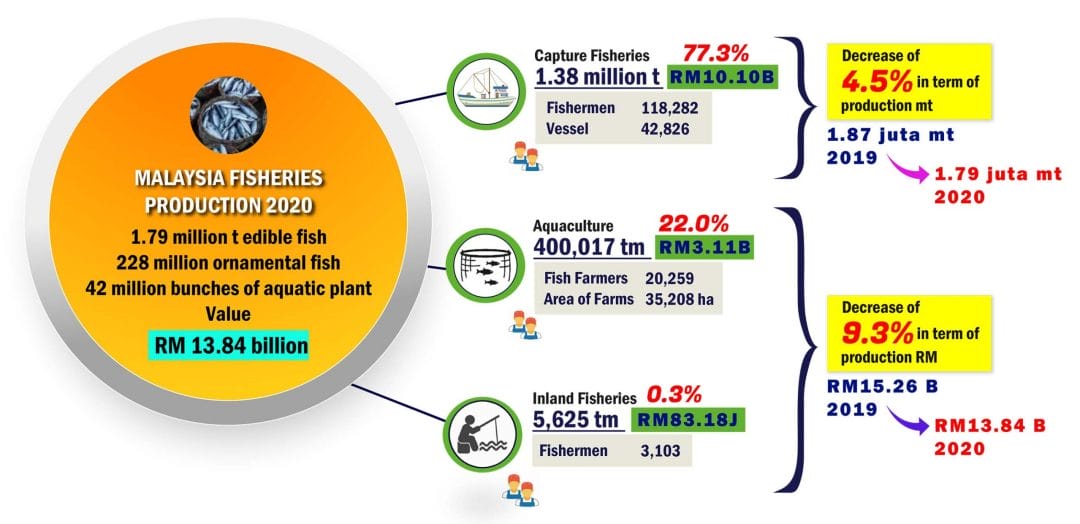

Fisheries Industry Scenario Department Of Fisheries Malaysia Official Portal